If there is room for one more besides Donald J. Trump, former President of U.S., “Tariff Man”, the “Big Mac" who promised to “drain the swamp”, and the self-imposed “Crypto President”, who is very polarizing and full of ego, it is none other than Michael Saylor, billionaire, co-founder and former CEO of MicroStrategy who conceitedly thinks “Chaos is Good for Bitcoin”. Before diving into Saylor’s currently pompous journey as a “Bitcoin Maxi” who loves chaos, it is important to rewind back to how Saylor generated numerous wealth, built a “cult” hive among other narcissists and corporations, and ultimately bypassed laws as a fraudster whose own influence has played a major role in the crypto industry specifically Bitcoin.

MIT, Air Force

Saylor attended MIT (Massachusetts Institute of Technology) on an Air Force Reserve Officers’ Training Corps scholarship. Through MIT, Saylor joined the Theta Delta Chi fraternity where he met a young man named Sanju Bansal (more on Bansal in the following chapter). The institute formed Saylor’s confidence and gave him a new philosophy of thinking that by 1987, Saylor completed his studies at MIT with a dual degree: aeronautics & astronautics/science & technology.

Shortly after graduating, Saylor joined the military to be trained as a pilot. He became a 2nd Lieutenant in the U.S. Air Force but due to being diagnosed with health complications, Saylor had to forfeit his childhood dream. But that did not stop Saylor from pursuing his other passion of computer simulations and the development of computer models for software companies. After Saylor started working as a consultant for companies such as Dow, Dupont, Exxon, Saylor had enough confidence to reach out to fraternity buddy Bansal to co-found a new company.

MicroStrategy

In 1989, under both Saylor’s and Bansal’s visions, the two businessmen helped enterprises deliver intelligence everywhere, using the power of graphical operating systems and client server computing. MicroStrategy grew big enough to go public in 1998 (NASDAQ: MSTR). By 1999, Saylor established a 501(c)(3) non-profit organization dubbed The Saylor Academy (formally known as The Saylor Foundation).

The non-profit had donated millions to philanthropic causes including children's health, refugee relief, education, environmental conservation, and support for the arts. The foundation runs the Saylor Academy (Saylor.org), which offers free college education and continuing professional development courses to students worldwide.

As described above, the title of “non-profit” was a disguise to hide Saylor’s true intentions, which is to make money. By the early 2000s, Saylor was among the wealthiest man in Washington DC, with a net worth estimated at $7 billion. In practice, Saylor had more than enough to support a political candidate, fund projects under his own vision, and if he wanted to, run for President. But all that was about to change…

Dot-com Bubble Crash

The biggest loser of the dotcom crash

In 2001, the stock market saw a complete decline in momentum gain from the rapid rise in U.S. equity valuations fueled by investments in Internet-based companies. Companies like Yahoo! saw a 6 billion acquisition of former radio company Broadcast.com become a colossal loss; former pet supplies retailer Pets.com after opening in 1998 shut down two years later. As for MicroStrategy:

In 2001, Fortune Magazine published a list of the top losers of the Tech Bubble. Ranked #1 was none other than Michael Saylor, who had a whopping $13.53 Billion LOSS! MicroStrategy’s shares went from $3300 to $4 (-99.99% decline), and SEC even accused him of fraud.

Michael Saylor doesn’t like when people share the truth about him. https://t.co/2yp5zz7wl8 pic.twitter.com/S5jq6cH2h6

— CryptoWhale (@CryptoWhale) February 25, 2021

Even MicroStrategy’s own accountants, PricewaterhouseCoopers (operating now under the PwC brand) recommended for MicroStrategy to issue a "restatement." Saylor's company was losing, not making money for the previous two years. The restatement caused MicroStrategy's stock to plunge 60 percent in a day. (The share once worth more than $300, now sold for about $3.50.) The company has been forced to settle a wave of lawsuits from angry investors.

SEC Lawsuit

Litigation Release No. 16829 / December 14, 2000

Accused of fraud by the SEC (Security Exchanges & Commission), Saylor himself had to pay a $350,000 fine and give up about $8 million of "ill-gotten gains." The full statement is provided above; basically, Saylor along with Bansal and former CFO (Chief Financial Officer) Mark Lynch should have reported net losses from 1997 up to 2000 instead of reporting on exaggerated positive net income. For many years up until 2013, Sangal would claim Saylor has become less “bombastic”; Saylor even claimed he has become more “humble” and “practical”. This is far from the truth.

Initial skepticism of Bitcoin

#Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.

— Michael Saylor� (@saylor) December 19, 2013

Before Saylor went insane over Bitcoin, he initially compared Bitcoin to online gambling. He was surprisingly correct but shortly after, Saylor bought Bitcoin:

“I’m really ashamed to say — I didn’t know I tweeted it until the day that I tweeted that I bought $250 million worth of Bitcoin.” - Michael Saylor

In a 2020 podcast interview with Anthony Pompliano (investor, Bitcoiner, Founder & CEO of Professional Capital Management, PMC (Professional Managerial Class) gatekeeper of the establishment, Saylor claimed he forgot ever saying anything like that. This is petty, nothing new as most establishment politicians and billionaires have reiterated the same former negative stance of Bitcoin, only for all of them to collectively years later flip 180 and overly advocate for Bitcoin. This all seems to be one collaborative script, to exploit Bitcoin to ultimately reveal Bitcoin’s true intentions: a ponzi, MLM (multi-level marketing) participation into an unregulated “decentralized” blockchain network where only the rich and the biggest hoarders of Bitcoin, aka whales, stay above everyone else.

Expansion of MicroStrategy and Tel Aviv

For more than 15 years, MicroStrategy has expanded its business in Israel. Partnering with MicroStrategy is I.E. Mittwoch & Sons, the leading Reseller and Distributor of both MicroStrategy BI (Business intelligence) and Dashboards solutions, in conjunction with Teredata Data Warehouse.

Mittwoch vision for MicroStrategy BI is to serve as the Trusted Advisor of the Chief Data Officer (CDO) or the Head of BI, and to become the single point of consultancy in all related matter for both Big Data use cases as well as traditional MicroStrategy Dashboard or BI.

All of this expansion has been under Saylor’s leadership to majorly influence Israel while he was still serving as CEO of MicroStrategy, up until August 2022. While Saylor has never publicly revealed his personal views on Israel, there is no doubt that Saylor is pro-Israel all while staying completely silent on the matters of Gaza. And how about Saylor’s complete silence, never referencing or citing Wikileaks founder Julian Assange, a once curiously optimistic Bitcoiner, but more importantly, a journalist of truth, who very recently spoke publicly to the Parliamentary Assembly of the Council of Europe about his isolation from the world.

Tax fraud lawsuit

District’s complaint against Saylor and MicroStrategy

Michael Saylor to settle D.C. tax fraud case for $40 million

In another lawsuit, in 2021, Saylor was sued by both the OAG (Office of the Attorney General for the District of Columbia) and whistleblowers represented by law firm Cadwalader, Wickersham & Taft for tax fraud. Saylor was alleged of dodging city income taxes by claiming to live in either Virginia (where MicroStrategy is headquartered) or Florida (Saylor’s personal home) while owning a lavish Georgetown penthouse including luxury yachts. Between 2005 and 2020, Saylor had owned over $25 million in income taxes, bragging to friends and acquittances about evading D.C. taxes, was seen more physically present in the District of Colombia rather than Florida based on allegations of detailed flight logs from MicroStrategy’s corporate jet and location-tagged social media posts.

Rather than stall the court, Saylor and MicroStrategy agreed to pay $40 million to settle these tax fraud allegations, which was the largest income tax fraud recovery in city history for the District of Colombia. For Saylor, it was of little consequence because he has not become more “humble” or “practical”. When Saylor stepped down as CEO of MicroStrategy in 2022, Saylor had walked away with a $1.98 billion impairment loss on his Bitcoin holdings.

“Chaos is good for Bitcoin”

“You do not sell your Bitcoin”

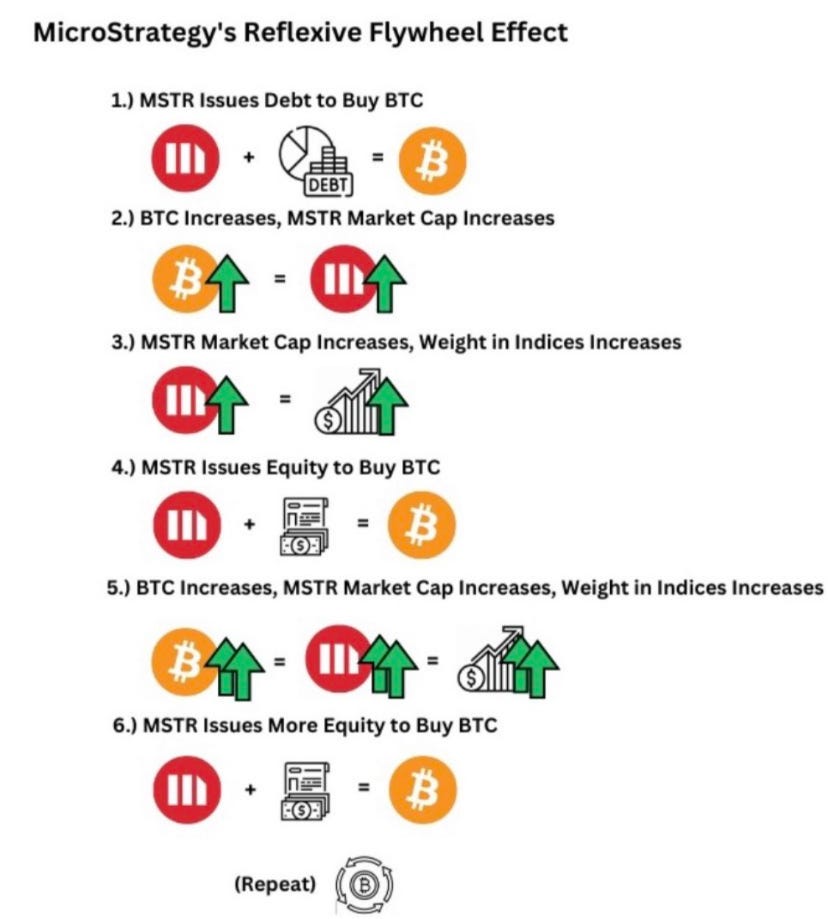

And once again, Saylor does not truly understand how Bitcoin works as a blockchain network. All he understands about Bitcoin is making in terms of Bitcoin. But to make more money, Saylor has always had to go on debt, borrow money to make equity, profit off of an unregulated ponzi scheme within capitalism, including likely ties of the blockchain originating back to the NSA and CIA,

To prove how deranged Saylor gotten over years, including standardizing everything having to revolve around Bitcoin, one can psychoanalyze how Saylor’s mental health has declined over time, as well as his uphill battles of grossly accumulating an absurd sum of money while also losing all that absurd sum of money, which is what late stage capitalism revealed about billionaires and their chaotic mindsets such as Saylor.

In the two video shorts, Saylor only sees things as a moneymaker and an investor. He could care less about any of his affiliate’s connections strongly linked to U.S. Imperialism and Zionism. Corporate media (CNBC, Fox Business, Bitcoin Magazine, Benzinga, etc) and crypto communities (“Altcoin Daily”, Lark Davis, Isabella Santos, Natalie Brunell, Randi Hipper, etc) have all done themselves a disservice by downplaying any critiques or doubts about the competency of a chaotic man, let alone critiquing the current Zionist direction Bitcoin and all cryptocurrency are leading Western societies towards: Dystopia, where only a select few Bitcoin Zionists such as BlackRock burn the world to the ground.

With that said,

#FreePalestine 🇵🇸 #FuckBitcoin