Michael Saylor's inevitable downfall per Bitcoin and chaotic nonsense

Never forget at one point Saylor lost his company a whooping $14 billion during Dotcom hype

It’s been a while I’ve written Substack articles. I have no excuses; in reality, there are overwhelming amounts of scams and ponzis involving crypto as of late, especially from the President of the United States, Donald Jester Trump.

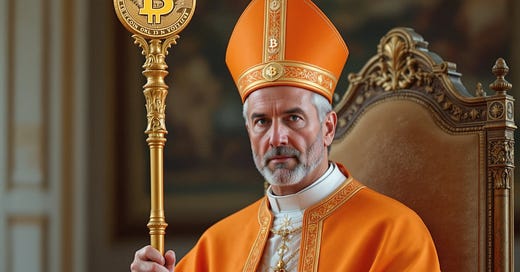

To begin again, I’m revisiting the chaotic billionaire himself, Michael Saylor.

Michael Saylor (Here we go again)

Michael Saylor the Chaotic Bitcoin Zionist

Michael Saylor: "The world's going to [chaotically] be remade"

To recap, Saylor is among one of the biggest hoarders of Bitcoin, a not so decentralized digital currency that has reached ATHs (All Time Highs) in part due to financial institutions, billionaires, and corporations such as Saylor’s company, MicroStrategy (MSTR), accumulating stacks of Bitcoin. Saylor, much like a majority of establishment figures, is gambling with Bitcoin, hyping and self-promoting MicroStrategy as a "Bitcoin company”. Okay but what is a “Bitcoin company” even offering? Nothing, except for the determination of the U.S. to invest its declining dollar (USD) into an unregulated blockchain technology. To this day, there are compounding theories and evidence to point to Bitcoin being secretly developed and launched from the “deep state” (something “Satoshi Nakamoto”, inventor(s) of Bitcoin originated from) into the U.S. public to redirect conversations about hard metal assets and fiat currency away and instead direct conversations promoting digital currency including Bitcoin.

Saylor is one such thing individual who has constantly promoted Bitcoin by grifting nonsensical, asinine, and frankly idiotic commentary, tweets, and Ai to promote hype, speculation, and FOMO (Fear of Missing Out). In my previous articles focusing on Saylor, I pinned how Saylor’s agendas aligned perfectly with Zionists who want to silence any critiques about Israel and advanced technology (which would do more harm than good such as Ai and blockchain technology). I also explained how Saylor company’s continuously borrows loans to buy Bitcoin, which the pumps the value of Bitcoin. But in order to do so, Saylor has to ensure the price of Bitcoin remains high enough so that 1) MicroStrategy and he profits and 2) Saylor pays off his loans. If Bitcoin’s value dumps (either due to a quantum attack, or reactions following geopolitical decisions, or other whales collectively deciding to dump their Bitcoin without Saylor knowing), then Saylor’s Bitcoin portfolio will plummet into a colossal net loss (per Bitcoin that is).

DO NOT SELL YOUR BITCOIN! - Saylor

Remember when Trump mentioned “NEVER SELL YOUR BITCOIN” last year at Nashville Bitcoin Conference (aka RNC 2.5?) It was actually Saylor who first imposed this statement, back in 2022, when he was asked whether he was more “bullish” (as in optimistic about an investment). Within the crypto community, Saylor has become something of a poster child, especially when it has to do with Bitcoin. But what a lot of crypto investors don’t realize (until it’s too late) is that Saylor has been scamming everyone to keep buying Bitcoin so that Saylor’s own portfolio continues profiting in net gain. And then, when there is an outbreak, Saylor, who claims he’s never sold any of his Bitcoin, can buy more Bitcoin (as a result of investors selling their Bitcoin due to a net loss or their net gain being close to their average cost.

Saylor’s Ponzi Empire

My evil genius strategy that would make the US $100 trillion in a heartbeat —you dump gold, demonetize the entire gold network. You buy 5-6 million #Bitcoin and monetize the #BTC network. The price of Bitcoin goes to the moon. The US is the big beneficiary. - Michael Saylor

Michael Saylor copies Grayscale, tells US to crash gold for BTC

Michael Saylor on BTC at $100K and the Future of MicroStrategy

Five years ago, Grayscale encouraged retail gold owners to sell their gold for BTC — specifically, its Grayscale Bitcoin Trust (GBTC). Grayscale claimed that Bitcoin offered better scarcity and superior utility in the modern world. Saylor would copy Grayscale’s script, which got so much attention when MicroStrategy directly bought Bitcoin instead of Grayscale’s GBTC. Saylor, much like other billionaires and financial institutions, narrated the upcoming dystopian future of Bitcoin (of which I have dubbed Bitcoin as “Zionist Bitcoin” due to similar overlaps between the crypto industry here in the U.S. and the U.S.’s obsessive commitment to supporting Israel and its genocide agenda.)

Five months ago, Saylor was interviewed by Alex Thorn, Head of Firmware Research for Galaxy Capital to spread the agenda for investors to dump gold. In fact, for a while now, the U.S. Senate, namely Senator Cynthia Lummis, has been pushing for a “Bitcoin Strategic Reserve”, to where the U.S. government would accumulate and hold Bitcoin as a long-term asset. But there is a sinister agenda; for the U.S. government to dump gold and go from heavily holding physical hard metals (gold) into digitally holding crypto is a deliberate market manipulation.

Like Lummis, Saylor’s strategy involves dirty politics, specifically referring to China and Russia, who would potentially (as a result of tariffs perhaps?) sell its assets including gold and buy Bitcoin instead. By doing so, at least according to Saylor’s narcistic ego, money flows back into the U.S. And if that wasn’t dumb, according to Saylor via Ai Stormtrooper, “Every Empire needs Bitcoin”; Saylor is on brand, admitting he is on the side of the bad guys.

Saylor’s inseparable ties to Trump

Decoding Bitcoin’s ‘Trump 47’ Block

Michael Saylor Shrugs Off TRUMP Token, Doubles Down On Bitcoin And Strength Of US Dollar

Trump Media Seeks to Raise $3B for Crypto Purchase: FT

Back in January, MARA Holdings stupidly mined a Bitcoin block that upon close examination featured a pixelated face of Trump. That’s an “uh oh” for Saylor; if Saylor (and largely Bitcoin communities) continue spouting Bitcoin, then consequently, they are unintentionally promoting Trump and every policy, scandal, propaganda that Trump is carrying out via for Israel. To anyone who’s still holding Bitcoin, why even bother when there will “always” be that one block, that one embarrassing reminder of what Bitcoin has come to represent these days.

Earlier in March, Trump held a private crypto meeting, featuring Saylor and other crypto entrepreneurs. There was footage depicting a distant Saylor looking down in horror as Trump talked and made up nonsensical stuff about crypto. After all, it was Saylor’s idea who encouraged the Trump administration back in 2024 to go all in on crypto. Saylor should have abandoned any science involving the creation of monsters who can’t be properly controlled…“Franken-Trump” anyone?

Earlier in May, Hadley Gamble of Al Arabiya English interviewed Saylor. Saylor tried to separate himself from Trump by shrugging off Trump’s $TRUMP memecoin; but the damage is already done. Like Trump, Saylor’s coughing up dumb predictions, such as Bitcoin being 10x to that of Gold, with Bitcoin growing 20% a year afterwards. You can’t make this shit up; where is Saylor getting these numbers from? Also, Saylor gave Gamble two hypothetical scenarios of what someone with a billion dollars could do if they were dropped in Africa. Saylor’s disingenuous regard for what African citizens may think about capitalist billionaires such as Saylor is unforgivable.

In the 21st century, how do I keep my money?

If I gave you a billion dollars and I dropped you in Africa and I said go buy anything you want. You could buy a diversified portfolio of real estate or equity or currency or bonds anything at all in any country in Africa.

Or…you can buy digital property that sits in cyberspace worth the same billion dollars and you can move it on a thumb drive or you can zap it from point A to point B on your phone and you can custody it anywhere in the world on an hour’s notice. I think you would choose option B, and option B is what Bitcoin represents. - Michael Saylor

And just today, the Trump Media is seeking to raise $3 billion to purchase more crypto: by using Saylor’s MicroStrategy playbook. Saylor is stuck with Trump whether or not he wants to acknowledge that.

U.S. President Donald Trump's media company, Trump Media (DJT), is looking to partner with crypto exchange Crypto.com to launch a series of exchange-traded products (ETPs) and funds (ETFs).

Trump Media shared plans earlier this year to launch a financial services platform focusing on crypto and customized exchange-traded funds. It also said it wants to partner with crypto exchange Crypto.com to launch the ETF products. - CoinDesk

MicroStrategy gets sued again!

Michael Saylor's Strategy Hit With Lawsuit Following $5.9B Bitcoin Loss

Michael Saylor's MicroStrategy hit with Class Action lawsuit

Last week, MicroStrategy was hit with a lawsuit. Anas Hamza, a Californian investor, filed a Class Action lawsuit against MicroStrategy, its executives, and Saylor on May 16. Hamza argued that Strategy “overstated” the profitability of its Bitcoin treasury strategy before disclosing a first-quarter loss. The lawsuit seeks damages for violations of the Securities Exchange Act, 15 U.S.C. § 78 m(a), regarding disclosures that allegedly misled investors concerning material facts.

The Michael Saylor pizza cult

LADoger interviewed GladiatorMSTR ...in a swimming pool

Michael Saylor - The Main Character of Bitcoin

Buy a Burger With Bitcoin? Beware the Tax Risks, Experts Warn

"I'm a fan of Saylor and will continue to hold $MSTR" - MitchellHODL

Michael Saylor issues stern advice to companies

Speaking of lawsuits, where does Saylor get much his Ai art from? From “LADoger” that’s who, who has a weird obsession with Saylor; most likely he made a lot of money off of MSTR shares.

It's pretty wild how within 5 years Saylor infiltrated maxi culture, created a cult of personality around himself, orange washed his shitcoin to the plebs, and now the majority of the class of 2025 are stacking MSTR instead of BTC. - Pledditor

Pay with Dollars. Eat the Pizza. Keep the Bitcoin. Not my words, Saylor’s.

The Bitcoin meme involving pizza goes back to the infamous story of the very first Bitcoin transaction made on May 22, 2010…buying two slices of pizza. Point being, every douchebag including Saylor has used that tale as a grift to convince investors and novices that Bitcoin is legit...under capitalism, and if you want to pay taxes on top of your initial transaction (whether it be a pizza, a steak, a milkshake…or a burger.)

When a taxpayer buys and sells Bitcoin (or any cryptocurrency), they must calculate the difference between the price at which the asset was purchased and its current market value. -Liz Napolitano, Decrypt

The most upsetting about Saylor’s message is that Saylor didn’t use Bitcoin…he used the dollar. As previously mentioned, Saylor will use dirty tricks to keep any advantages he has to himself and his billionaire Bitcoin partners.

“Trust me bro!”

Twitter user “MitchellHODL” recently asked Saylor a significant question at an event one day prior to the cancerous Las Vegas Bitcoin Conference. (I’m dubbing that huge event as another Republican National Convention aka RNC 2.5)

“Hey Mr. Saylor. Huge fan of everything you’ve done; does Strategy have any plans to launch their proof-of-reserves (PoR)?” - MitchellHODL

What is PoR? PoR is a method for cryptocurrency exchanges to demonstrate that they hold enough assets to cover user deposits. The transparency behind PoR is reassuring that users’ funds are secure, with the clean option of exchanges to fulfill withdrawal requests. Now does MicroStrategy fit that criteria?

According to MitchellHODL, Saylor thought publishing on-chain PoR would be a “bad idea” because 1) security risk & 2) irrelevant without also having Big 4-audited liabilities. Once again, Saylor is covering his tracks, hiding something that he knows that everyone else does not know, to prevent anyone from doubting Saylor’s massive ponzi scheme. Even MitchellHODL in a later tweet foolishly admits he is still a fan of Saylor and MicroStrategy, and clarifies that an individual Bitcoin HODLer would be more susceptible to wrench attacks should they publicize their addresses whereas MicroStrategy’s would not be the case…because Bitcoin under MicroStrategy’s care belongs to its shareholders. It’s a weak sauce argument, a red flag.

“If you publish your wallet, that's an attack vector for hackers, nation-state actors, every type of troll imaginable. It creates so much liability you should think twice before you ever do it. - Michael Saylor

Michael Saylor is Running a Ponzi Scheme Using a Public Software Company and Bitcoin

Indie Media Today - How Did We Miss That? #154

Finally, to know more about Saylor from an independent perspective, I recommend checking out Indie News Network and their breakdown of Saylor from last month. Much of what Indie and Reef Breland discussed regarding Bitcoin, MicroStrategy, Saylor is still taking place. Instead of being a company that offer actual software products, MicroStrategy has become a “Bitcoin holding company”, with nothing to offer other than the hobby to hype and to SCAM!

-Golden Monarch